At its core, the simplest way to figure out Customer Lifetime Value is with this formula: CLV = Customer Value × Average Customer Lifespan. This gives you a clear picture of the total revenue you can realistically expect from a single customer over the entire time they do business with you.

Why CLV Is More Than Just a Metric

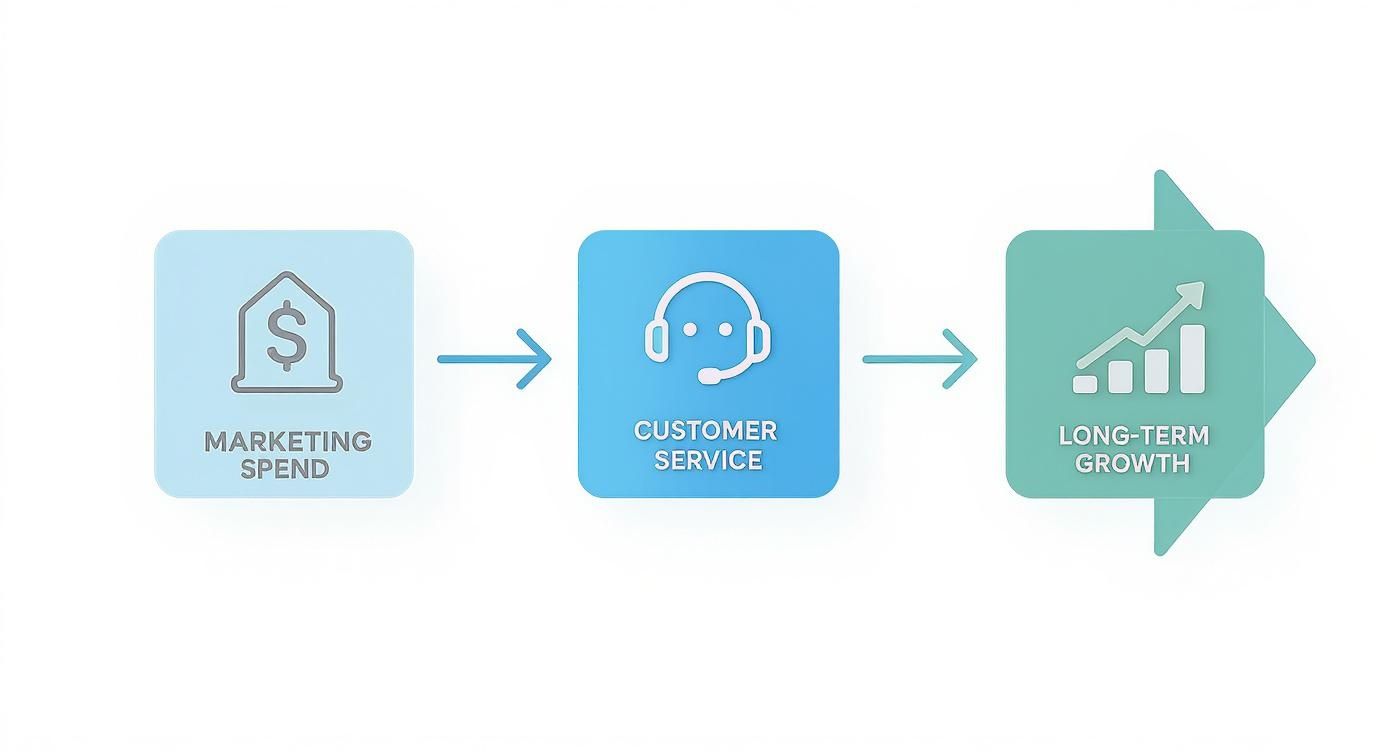

Before we get into the number-crunching, it's important to grasp why CLV is such a game-changer for any home service business. Don't think of it as just another number on a spreadsheet; think of it as your strategic compass. It's the key to making smarter decisions on everything from your marketing spend to how you train your service team.

A solid understanding of CLV pulls you out of a frantic, short-term mindset focused on just getting the next lead. Instead, it pushes you toward a more sustainable, long-term strategy built on solid customer relationships. You stop just chasing the next one-off repair job and start thinking about how to turn that job into a multi-year service contract. This shift in perspective is what builds a truly resilient and profitable business.

From Calculation to Strategic Compass

Calculating CLV brings the real financial impact of customer satisfaction and retention into sharp focus. It gives you the hard data you need to justify spending on things that truly improve the customer experience, like hiring top-notch CSRs or investing in better scheduling software.

When you know the average customer is worth $5,000 to your business over their lifetime, spending $50 on a follow-up call to make sure they're happy suddenly looks like a smart investment, not an expense.

This single metric empowers you to make data-driven decisions that have a ripple effect across your entire company.

- Marketing Budgets: You can set your Customer Acquisition Cost (CAC) with confidence because you know exactly what a new customer is actually worth.

- Service Offerings: It helps you pinpoint which services bring in the most valuable, long-term clients, so you can double down on what works.

- Customer Service: You can segment your customer base, offering premium, proactive service to your highest-value accounts to ensure they stick around for the long haul.

By seeing CLV as a strategic tool, you turn a simple calculation into your most powerful lever for growth. It’s the difference between guessing what works and knowing what drives sustainable profit.

Ultimately, the CLV formula provides the 'why' behind building strong customer relationships. It connects your day-to-day operations—answering phones, dispatching techs, and following up after a job—directly to the long-term financial health of your business. The numbers don't just tell you about past performance; they light up the path to future growth by showing you where to invest your time, money, and energy for the biggest return.

Getting to Your Foundational CLV

Alright, let's roll up our sleeves and get into the numbers. The good news is that calculating a foundational Customer Lifetime Value doesn't require a data science degree. It’s about taking the information you already have and piecing it together to see the real, long-term worth of your customers.

We're going to walk through each part of the formula and then apply it to a real-world scenario you can probably relate to. This is where abstract data becomes a powerful tool that can guide how much you spend on marketing and where you invest in customer service.

Think of it this way: CLV is the bridge connecting what you spend today to what you'll earn tomorrow. It's the key to building sustainable, long-term growth.

Breaking Down the Core Variables

To get your baseline CLV, you just need to hunt down three key metrics in your business data. Each one tells a crucial part of your customer's story.

- Average Purchase Value (APV): This is simply the average amount a customer drops every time they do business with you. Just take your total revenue over a set period (say, a year) and divide it by the total number of individual purchases in that same timeframe.

- Purchase Frequency (F): How often does a typical customer come back to you within that period? To figure this out, divide the total number of purchases by the number of unique customers who made them.

- Customer Lifespan (L): This is your best guess at how long the average customer stays with you. You can estimate this from historical data or get a quick figure by using the inverse of your churn rate (for example, 1 / Churn Rate %).

The formula itself is straightforward: CLV = (Average Purchase Value × Purchase Frequency) × Customer Lifespan. This simple multiplication gives you a surprisingly powerful estimate of the total revenue you can expect from a single customer.

A Home Services CLV Example

Let’s put this into practice with a fictional HVAC company we'll call "CoolBreeze HVAC."

Imagine the owner of CoolBreeze sits down and pulls the numbers from last year. Here's what they find:

- Average Purchase Value: They brought in a total revenue of $500,000 from 1,000 separate jobs. That makes their APV $500 ($500,000 / 1,000).

- Purchase Frequency: Those 1,000 jobs came from just 400 unique customers. So, their frequency is 2.5 purchases per year (1,000 / 400). This accounts for everything from annual tune-ups to emergency repairs.

- Customer Lifespan: They know from experience that once a customer signs on, they typically stick around for about 8 years.

With these numbers, we can plug them right into the formula:

CLV = ($500 × 2.5) × 8 = $10,000

That $10,000 figure is a game-changer. It tells the owner that landing a new customer isn't just about a one-time $500 job. It's about starting a relationship that could be worth $10,000 in revenue over the long haul.

While this basic version doesn't factor in costs, it provides a crucial baseline. Managing all the data behind these calculations is essential, especially as you scale. For businesses that handle lots of customer interactions and sales data, getting administrative support can be a huge help; you can learn more by checking out our guide on hiring virtual assistants for Shopify.

Of course, you can get more advanced. A deeper analysis would also subtract the cost to serve that customer. For instance, if a customer generates $10,000 in revenue annually for five years (a $50,000 gross), but it costs your business $15,000 to serve them during that time, their net CLV is actually $35,000.

Beyond the Rearview Mirror: Moving to Predictive CLV Models

The standard CLV formula is a fantastic tool for getting a snapshot of past performance. It gives you a solid baseline, but here's the thing: it’s all based on historical data. It tells you where you’ve been, not where you're going.

What if you could shift from looking in the rearview mirror to having a real-time GPS for your customer relationships? That’s exactly what predictive CLV models do. They move past simple averages to forecast what your customers are likely to do next, giving you an actionable picture of their future worth.

This isn't just for data scientists running complex algorithms. The core idea is simple: use what customers are doing right now to anticipate what they’ll do in the future. This lets you step in to nurture a relationship before it goes cold or double down on a customer who’s showing all the signs of becoming a long-term fan.

Tuning Into Behavioral Signals

Making the leap to predictive CLV means you start tracking key behavioral indicators—the little signals that whisper "loyalty" or shout "churn risk." Instead of just relying on broad averages across your entire customer base, you zoom in on what individual customers are actually doing.

So, what signals should you be looking for?

- Service Frequency: Think about that customer who always schedules their annual HVAC maintenance like clockwork. What happens when they miss an appointment for the first time in five years? That’s a red flag. A dip in frequency is one of the earliest warnings of potential churn.

- Engagement with Your Communications: Are customers opening your emails about seasonal promotions? Or are your messages collecting dust in their inbox? If engagement drops off a cliff, it often means they’re tuning you out.

- Recent Support Interactions: A sudden spike in support tickets from a single customer could mean two very different things. It might signal frustration with a recent job, or it could show they’re highly engaged with a new service you've offered. The context is everything.

By layering these behavioral data points over your basic CLV calculation, you get a much richer, forward-looking metric. It helps you see which of your $10,000 CLV customers are on a path to loyalty and which ones might be gone by next month.

The classic formula—CLV = customer value × average lifespan—doesn't go away. Instead, predictive models just make the "average lifespan" part a whole lot smarter by factoring in real-time churn probability based on these signals.

Turning Data Into Proactive Strategy

Ultimately, the goal here is to get ahead of the game. When you can forecast churn with some degree of accuracy, you can build targeted strategies to stop it before it happens.

Imagine setting up an automated alert for any customer whose service frequency drops by 50%. That alert could trigger a personalized check-in call from one of your team members—not a sales pitch, but a genuine "Hey, we haven't heard from you in a while, is everything okay?"

For those looking to really dig into the data, learning about using AI for data analysis in Excel can be a game-changer. These tools can help you process behavioral data more efficiently and spot patterns you might have otherwise missed. It’s all about shifting your business from a reactive state (fixing problems after they’ve happened) to a proactive one where you solve issues before they ever touch your bottom line.

How Retention and Discount Rates Reveal True Value

https://www.youtube.com/embed/OwCATJh4lNg

To get a CLV calculation that your finance team will actually take seriously, you have to go beyond the simple math. Two critical factors are often left out of basic formulas: the Retention Rate and the Discount Rate.

These aren't just fancy financial terms. They ground your CLV in reality, turning a loose revenue guess into a solid financial forecast that reflects the genuine, long-term health of your customer base.

The Leaky Bucket and the Value of Time

First up is the Retention Rate. Let’s be honest—no business keeps every single customer forever. People move, needs change, and competitors exist. This is the "leaky bucket" reality we all deal with. By figuring out the percentage of customers who stick with you year after year, you get a much clearer, more sober picture of your future revenue. This is also why it's so important to have strategies to retain customers and build real loyalty.

Next, we have to talk about the time value of money. It’s a simple concept: a dollar today is worth more than a dollar you expect to get a year from now. Why? Inflation, for one. But you also lose the opportunity to invest that dollar and make it grow. The Discount Rate adjusts for this. It’s usually tied to your company's cost of capital and typically falls somewhere in the 8-12% range, bringing future earnings down to their present-day value.

A More Financially Sound Formula

When we pull these two elements into the equation, our CLV calculation gets a whole lot smarter. It now accounts for the real-world risk of losing customers and the financial principle that future money isn't as valuable as today's money.

The formula looks like this:

CLV = Margin × (Retention Rate / (1 + Discount Rate − Retention Rate))

This approach essentially treats your customer base as an asset that depreciates over time as customers naturally churn. It’s a model that speaks the language of finance.

This isn't just another way to crunch the numbers. It gives you a CLV figure grounded in solid financial principles, making it a metric you can trust for strategic planning, budgeting, and deciding how much you can really afford to spend to acquire a new customer.

Let's plug in the numbers for our HVAC company again. We'll use their annual margin of $1,250 per customer, an 80% retention rate, and a 10% discount rate.

- Simple CLV (the old way): $10,000 (just based on revenue)

- Advanced CLV (the smart way): $1,250 x (0.80 / (1 + 0.10 – 0.80)) = $3,333

Yes, $3,333 is a lot lower than $10,000, but it's also a number you can actually count on. It reflects profit, not just revenue, and factors in the realities of customer churn and finance. This is the number that should guide your marketing spend.

Boosting this figure comes down to improving customer retention. This is where dedicated marketing efforts can make a huge impact. If you're looking for help managing those campaigns, it might be worth exploring how to hire a virtual assistant for internet marketing.

Turning CLV Insights into Profitable Actions

Alright, so you've done the math and calculated your CLV. What now? That number isn't just a vanity metric to stick on a report; it’s a powerful tool meant to be used. The real magic happens when you translate that data into a concrete action plan.

Armed with your CLV, you can finally move from guessing what works to knowing what drives profit. It gives you a clear roadmap for where to invest your time and money for the best return. Suddenly, marketing budget meetings become a lot easier when you can show exactly why one channel deserves more funding than another.

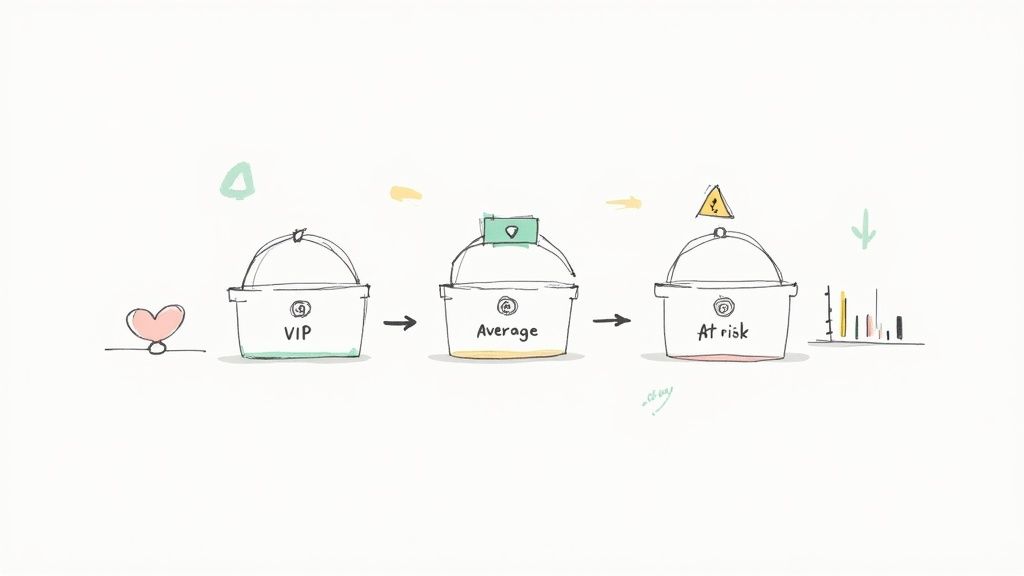

Segment Your Customers for Maximum Impact

One of the smartest first steps is to segment your customers based on their CLV. Let's be honest, not all customers bring the same value to your business, so it makes no sense to treat them all the same. I've found it helpful to break them down into three simple tiers.

- VIPs (High-CLV): These are your all-stars. They spend more, they stick around, and they probably tell their friends about you. For this group, your mission is retention and delight. Think proactive service calls, exclusive offers, or even just a personal check-in. Make them feel like the champions they are.

- Average Joes (Mid-CLV): This is the core of your business. The goal here is simple: nurture and grow. Find ways to get them to book a bit more often or introduce them to a premium service they haven't tried yet. A little nudge can go a long way.

- At-Risk Accounts (Low-CLV): These are the customers who buy once and disappear, or maybe they just use your cheapest service. Your strategy here is about re-engagement or optimization. You could try a win-back email campaign, but you might also decide it's best to simply minimize the cost of serving them to protect your margins.

By tailoring your approach, you ensure your most valuable resources—time, money, and your team's attention—are invested in the customers who contribute most to your bottom line.

Justify Budgets and Optimize Acquisition Costs

Your CLV is also the key to understanding your Customer Acquisition Cost (CAC). A healthy business needs a good balance between what you spend to get a customer and what they're worth to you over time. A classic benchmark is the 3:1 LTV to CAC ratio. For every dollar you spend to land a new client, you should ideally get back at least three dollars over their lifetime.

This simple ratio removes the guesswork from your marketing budget. If you know your average CLV is $3,000, then you can confidently spend up to $1,000 to acquire that type of customer while staying profitable.

Even better, you can start analyzing which marketing channels are actually bringing you the best customers. You might find that the leads from your Google Ads have a much higher CLV than the ones from that local mailer campaign. That insight is gold. It tells you exactly where to double down and where to pull back.

Juggling all these targeted campaigns and customer check-ins takes work. If your team is already swamped, learning how to hire a virtual assistant can be a game-changer. It gives you the support you need to put these strategies into motion without burning out your existing staff.

Got Questions About CLV? You're Not Alone.

Knowing the formula for Customer Lifetime Value is one thing, but actually putting it to work in your own business is another beast entirely. It’s totally normal for questions to pop up once you start digging into your own numbers.

Let's walk through some of the most common sticking points I see home service pros run into.

"Where on Earth Do I Find These Numbers?"

This is, without a doubt, the biggest hurdle for most business owners. You might think you need some fancy analytics platform, but the good news is you probably have all the data you need tucked away in the tools you already use every day.

- Your Accounting Software: Pop open your QuickBooks or whatever you use for invoicing. It's a treasure trove. You can easily find your total revenue and the total number of invoices, which is everything you need for Average Purchase Value.

- Your CRM or Scheduling Software: Your customer list is right there. The system you use to book jobs and manage customer information holds the keys to figuring out how many unique customers you have and how often they've hired you. This is where you’ll nail down your Purchase Frequency.

- Your Own Brain: Seriously. For Customer Lifespan, don't get hung up on finding a perfect number in a spreadsheet. You have a gut feeling for how long the average customer sticks with you. Is it a couple of years? Five? Start with an educated guess. You can always make it more precise later.

The biggest mistake is waiting for perfect data. A good CLV estimate today is infinitely more useful than a perfect one you never get around to calculating. Just start.

Historical vs. Predictive CLV: Which One Should I Use?

This is a great question. Think of it like driving a car.

Historical CLV is like looking in the rearview mirror. It uses all your past data to tell you what a customer was worth. It’s straightforward, reliable, and gives you a rock-solid baseline.

Predictive CLV is like looking at the GPS. It uses more complex models and current customer behaviors—like how often they call or what services they buy—to forecast what they will be worth in the future.

For 99% of home service businesses getting started with this, historical CLV is the way to go. It delivers the core insights you need to make better decisions right now. Once you get comfortable with that and have more data to play with, you can explore predictive models down the road.

How Often Should I Recalculate CLV?

There's no magic number here, but a great rule of thumb is to run your CLV numbers at least once a year.

An annual check-in is perfect for seeing how your big-picture strategies in marketing, customer service, or pricing are affecting the long-term value of your customer base.

However, if your business is growing fast or you're actively testing a bunch of new ideas (like a new marketing campaign or a membership plan), you might want to calculate it quarterly. This gives you much faster feedback on what’s actually moving the needle.

Ready to turn these insights into action? Phone Staffer can help you take care of your high-value customers and keep them loyal. Our remote CSRs and VAs make sure every call gets answered and every lead is followed up on, giving you the support system you need to boost retention and grow that CLV. Learn more about how we can help.