For any home service business that offers or partners with insurance providers, a steady stream of high-quality leads isn't just a goal; it's the lifeblood of your operation. Yet, sorting through the crowded marketplace of insurance lead generation companies can be overwhelming and frustrating. You need partners who deliver real, convertible opportunities, not just a list of names and disconnected numbers that waste your team's valuable time.

This guide cuts directly through the noise. We've compiled and analyzed the 12 best platforms for 2025, detailing their strengths, weaknesses, and ideal use cases specifically for businesses like yours. Whether you need real-time exclusive leads to close deals now or are exploring cost-effective aged data to fill your pipeline, this list will help you invest your marketing budget where it truly counts.

Our goal is to provide a clear, actionable resource to help you build a predictable growth engine. We'll examine each company's delivery model, pricing structure, and lead quality, complete with screenshots and direct links to help you make an informed decision quickly. To truly master the process of acquiring quality clients, it's beneficial to delve deeper into effective lead generation strategies that complement these services. This article is your first step toward finding a reliable lead partner and leaving the frustration of chasing bad leads behind.

1. NextGen Leads

NextGen Leads is a prominent US lead marketplace specializing in the health (under 65), Medicare, and auto insurance sectors. It distinguishes itself from other insurance lead generation companies by providing agents with a high degree of control through its self-serve buyer dashboard, allowing for real-time campaign management without long-term commitments or minimum spend requirements. This platform is ideal for agents and carriers who prioritize granular control and near-instant lead acquisition.

The platform operates on a dynamic bidding model where lead prices are determined by supply and demand. This means costs can fluctuate, especially in highly competitive geographic areas. However, this transparency allows agents to strategically target less saturated markets to manage their cost-per-lead effectively.

Key Features & Ideal Use Case

Website: https://nextgenleads.com/

NextGen Leads is best suited for independent agents or small to mid-sized agencies focusing on health and auto insurance who want to directly manage their lead flow and budget. The granular filtering capabilities allow you to target specific demographics and locations, making it a powerful tool for niche marketing strategies.

| Feature Analysis | Implementation & Use |

|---|---|

| Real-Time Lead Bidding | Actively monitor the dashboard during peak hours to adjust bids and secure high-intent leads as they become available. |

| Self-Serve Dashboard | Offers complete control over campaigns, allowing you to pause, start, and adjust targeting filters anytime. |

| CRM Integration | Connects with popular CRMs to automate lead nurturing and follow-up, ensuring no opportunity is missed. |

| Liberal Return Policy | Provides a straightforward process for returning invalid leads (e.g., wrong numbers, disconnected lines), protecting your investment. |

Pros:

- High Control: Transparent bidding and detailed targeting give you command over your campaigns.

- Flexibility: No minimums or long-term contracts.

- Specialization: Strong focus on high-demand health and Medicare verticals.

Cons:

- Price Volatility: Auction dynamics can drive up lead costs in competitive markets.

- Variable Volume: Lead availability can fluctuate based on geography and seasonality.

2. SmartFinancial for Agents

SmartFinancial for Agents is a large-scale US insurance marketplace offering a diverse mix of lead products, including shared data leads, exclusive leads, and live-transfer calls. The platform covers major lines like auto, home, life, and health, making it a versatile option for agencies with varied portfolios. It stands out among other insurance lead generation companies by combining a self-serve platform with extensive agent support resources, such as coaching and success programs, aimed at improving conversion rates.

The platform empowers agents with self-serve controls to manage their campaigns, allowing for adjustments to volume, budget, and geographic targeting. While pricing for different lead types requires a consultation with their sales team, this approach allows for a more tailored and strategic partnership. This blend of technology and human support makes it a strong choice for agents who want both lead volume and guidance on how to effectively work those leads.

Key Features & Ideal Use Case

Website: https://agents.smartfinancial.com/

SmartFinancial is best suited for agents and agencies looking for a blended approach to lead generation, utilizing both data leads and live calls across multiple insurance lines. It is particularly beneficial for those who appreciate dedicated support and training resources to help maximize their return on investment and improve their sales processes.

| Feature Analysis | Implementation & Use |

|---|---|

| Blended Lead Products | Combine live-transfer calls with data leads to create a consistent pipeline, using calls for immediate opportunities and data leads for nurturing. |

| Self-Serve Controls | Use the dashboard to set daily or weekly caps and pause lead flow during holidays or busy periods to maintain control over your budget and schedule. |

| Agent Resources & Coaching | Leverage the provided playbooks and training materials to refine your sales script and follow-up strategy, especially for newer agents. |

| Flexible Targeting | Filter leads by ZIP code and specific risk profiles to align incoming prospects with your carrier's underwriting appetite. |

Pros:

- Diverse Product Mix: Offers data leads and live-transfer calls across multiple insurance verticals.

- Agent Support: Provides valuable coaching, playbooks, and resources to boost conversion.

- Established Brand: A large, national marketplace generates significant consumer traffic and lead volume.

Cons:

- Shared Lead Competition: Base-level data leads are shared, requiring quick follow-up to compete with other agents.

- Variable Pricing: Costs are not transparent upfront and require a sales consultation.

3. QuoteWizard (for Agents)

QuoteWizard, now part of the LendingTree family, is an established lead provider delivering a high volume of web leads and live-transfer calls. It covers a broad spectrum of insurance lines, including auto, home, renters, health, and life insurance across the entire United States. The platform leverages significant search engine marketing (SEM) to attract consumers actively shopping for quotes, making it a reliable source for agents and teams needing a consistent, nationwide lead supply.

The company’s strength lies in its scale and the variety of lead types offered. Agents can choose between standard web leads delivered to their CRM or inbox, or opt for higher-intent live-transfer calls. While many leads are shared, their robust filtering options and daily volume reports allow agencies to fine-tune their campaigns and manage their budget effectively. This makes QuoteWizard one of the more versatile insurance lead generation companies for agencies that have a solid speed-to-contact process.

Key Features & Ideal Use Case

Website: https://agents.quotewizard.com/

QuoteWizard is best suited for mid-to-large-sized agencies or call centers that require a steady, high volume of leads across multiple insurance products and states. Its platform is ideal for teams equipped with the technology and staff to engage shared leads immediately, maximizing conversion potential before competitors can make contact.

| Feature Analysis | Implementation & Use |

|---|---|

| Live-Transfer Calls | Integrate live transfers directly into your sales workflow to connect with motivated buyers at the peak of their interest. |

| Nationwide Coverage | Leverage the platform to expand into new geographic markets or scale existing campaigns without supply limitations. |

| Multiple Lead Types | Diversify your lead sources by combining less expensive web leads with high-intent live calls to balance your cost-per-acquisition. |

| Daily Lead Reporting | Monitor daily lead volumes and performance statistics to make informed, data-driven adjustments to your targeting and budget. |

Pros:

- Broad Product & Geographic Reach: Offers extensive coverage across major insurance lines in all 50 states.

- Consistent Volume: High traffic from SEM provides a reliable and scalable lead supply for larger teams.

- Lead Variety: Provides flexibility with both web-based data leads and live-transfer calls.

Cons:

- Shared Lead Model: Many leads are sold to multiple agents, making speed-to-contact absolutely critical for success.

- Mixed Agent Reviews: Lead quality can vary by market; it's essential to vet performance in your specific territory.

4. EverQuote for Agents

EverQuote for Agents is a large-scale national marketplace that offers both data leads and live inbound calls, with a strong presence in the auto and home insurance verticals. What sets it apart from many other insurance lead generation companies is its optional Lead Connection Service (LCS), where a dedicated outreach team works your data leads for you and live-transfers qualified prospects directly to your agency. This hybrid approach is designed for agents who want a consistent lead volume but may lack the internal bandwidth for immediate, aggressive follow-up.

The platform provides agents with dedicated business consultants and goal-based programs to help optimize campaign performance. Pricing is not publicly listed and requires a consultation, as it's tailored to an agency's specific goals, target markets, and chosen lead types. This model emphasizes a more managed, partnership-style relationship rather than a purely self-serve marketplace.

Key Features & Ideal Use Case

Website: https://go.everquote.com/pro/

EverQuote is best suited for established agencies in the auto and home insurance markets that need a reliable, high volume of leads and can benefit from an outsourced initial contact process. The Lead Connection Service makes it an excellent choice for teams looking to maximize their agents' time by having them speak only with pre-qualified, interested consumers.

| Feature Analysis | Implementation & Use |

|---|---|

| Lead Connection Service (LCS) | Leverage this concierge service to handle the initial outreach and connect qualified shoppers directly, saving your team significant dialing time. |

| Data Leads & Inbound Calls | Choose between receiving consumer data to work internally or purchasing high-intent inbound calls for immediate engagement. |

| ZIP Code-Level Targeting | Focus your budget on specific geographic areas to align with your agency's license and market penetration strategy. |

| Dedicated Business Consultants | Work with your assigned consultant to review performance data and adjust your campaign for better ROI. |

Pros:

- Reduced Dialing Time: The optional LCS significantly improves connect rates and frees up agent capacity.

- Consistent Volume: As a major player, EverQuote provides a steady flow of leads in most markets.

- Multiple Lead Types: Offers flexibility with data leads, calls, and warm transfers.

Cons:

- Added Cost: The LCS feature increases the overall cost per acquisition.

- Opaque Pricing: You must schedule a demo to get a quote, making direct price comparison difficult.

5. MediaAlpha for Agents

MediaAlpha for Agents offers a highly transparent, programmatic lead-buying platform designed for agents who demand deep insight and control over their lead acquisition. It stands out among insurance lead generation companies by providing a dual model: agents can run auction-based campaigns with granular bidding controls or browse and buy individual leads a la carte. This flexibility caters to agents who prefer hands-on management and want to see lead attributes, sources, and sales status before committing to a purchase.

The platform’s auction model allows for precise targeting and budget management, while the browse-and-buy feature gives agents the unique ability to cherry-pick leads based on specific criteria. This level of transparency helps agents make informed decisions, ensuring their marketing spend is directed toward prospects with the highest potential. Certain programs even guarantee a lead is never sold to more than one agent per carrier, reducing direct competition.

Key Features & Ideal Use Case

Website: https://mediaalpha.com/agents/

MediaAlpha is best suited for tech-savvy agents and agencies that want to actively manage and optimize their lead-buying strategy. The platform's granular controls are ideal for those who enjoy the process of bidding, analyzing data, and adjusting campaigns in real-time to maximize ROI. It’s particularly powerful for agents who can leverage the pre-purchase data to tailor their sales approach.

| Feature Analysis | Implementation & Use |

|---|---|

| Programmatic Bidding | Set precise filters for your target demographic and actively manage bids to control cost-per-lead in a competitive marketplace. |

| Browse-and-Buy Leads | Use the a la carte marketplace to purchase specific, high-value leads one at a time, perfect for filling pipeline gaps. |

| Lead Source Transparency | Before purchasing, review the lead's source and sales status to gauge intent and quality, improving conversion rates. |

| Carrier Exclusivity | In applicable programs, take advantage of leads sold to only one agent per carrier to increase your chances of closing a deal. |

Pros:

- Strong Transparency: Unprecedented visibility into lead sources and sales status before purchase.

- Flexibility: Choose between running automated auction campaigns or buying individual leads as needed.

- Granular Control: Precise bidding and targeting options allow for highly optimized campaigns.

Cons:

- Requires Active Management: The platform is not "set and forget"; it demands active monitoring to optimize bids.

- Price Fluctuation: Lead costs are subject to market competition and can change rapidly.

6. ZipQuote

ZipQuote is a long-standing vendor in the insurance lead space, focusing on internally generated auto and home insurance leads. As one of the more established insurance lead generation companies, it emphasizes lead quality by sourcing prospects through non-incentivized channels, aiming to connect agents with consumers who have a genuine, immediate need for a P&C policy. The company provides both traditional internet leads and live call transfers across the United States.

The platform supports agents with dedicated account advisors who assist with onboarding and campaign optimization. This hands-on approach, combined with performance tracking tools, is designed to help agents monitor their spend and maximize their return on investment. This makes it a solid choice for agents who value support alongside their lead flow.

Key Features & Ideal Use Case

Website: https://zipquote.com/insurance-leads.html

ZipQuote is best for P&C-focused agents and agencies who want a consistent supply of non-incentivized leads and appreciate having dedicated support. The availability of both data leads and live transfers provides flexibility, allowing agents to choose the engagement method that best fits their sales process and team capacity.

| Feature Analysis | Implementation & Use |

|---|---|

| Non-Incentivized Sources | Focus sales efforts on these leads, as they typically represent higher-intent prospects actively shopping for insurance. |

| Live Call Transfers | Dedicate specific time blocks for your top agents to receive these calls, ensuring immediate engagement with warm prospects. |

| Account Advisors | Leverage your advisor for performance reviews and strategic advice on targeting specific zip codes or lead types. |

| Performance Tracking | Regularly review the ROI data provided to refine your budget allocation and pause underperforming campaigns. |

Pros:

- Higher-Intent Leads: Non-incentivized lead generation can improve conversion rates.

- Dedicated Support: Account advisors provide valuable onboarding and optimization guidance.

- Flexible Lead Types: Offers both data leads and live call transfers to suit different sales models.

Cons:

- Opaque Pricing: You must contact sales for pricing details; costs are not public.

- P&C Focus: Limited options for agents specializing in life, health, or Medicare.

7. Hometown Quotes

Hometown Quotes is a US-based lead provider specializing in auto, homeowners, life, and renters insurance leads. It carves out a niche among insurance lead generation companies by catering specifically to agents within major carrier networks. Their status as an approved vendor for several large carriers makes them an excellent choice for captive agents or those participating in carrier co-op programs who need to use sanctioned lead sources.

The platform offers custom pricing based on lead type and risk profile, which requires direct contact for a quote. This model is often supplemented by attractive promotions, such as deposit-matching offers for qualifying new agents. These incentives, combined with potential carrier subsidies, can significantly reduce an agent's net lead cost, making it a financially strategic option for those eligible.

Key Features & Ideal Use Case

Website: https://hometownquotes.com/insurance-leads/pricing/

Hometown Quotes is best suited for captive agents who must source leads from carrier-approved vendors or any agent looking to leverage co-op marketing funds. The platform’s integrations with common CRMs and raters ensure a smooth workflow from lead acquisition to quoting, while its promotions offer a lower barrier to entry for agents looking to test a new lead provider.

| Feature Analysis | Implementation & Use |

|---|---|

| Carrier Co-op Approved | Leverage your carrier's co-op or marketing reimbursement programs to subsidize your lead spend and lower acquisition costs. |

| Custom Pricing & Filters | Work with their team to define specific risk classes and geographic filters to receive leads that match your target market. |

| CRM/Rater Integrations | Connect the platform to your existing agency management system or rater to instantly push new leads and speed up your quoting process. |

| Deposit-Match Promotions | Inquire about current offers when signing up to maximize your initial budget and effectively double your starting lead volume. |

Pros:

- Ideal for Captive Agents: A go-to, approved vendor for many major insurance carriers.

- Cost-Saving Promotions: Deposit-match offers and co-op eligibility can significantly reduce net lead costs.

- Multi-Line Focus: Provides leads across key personal lines, including auto, home, and life.

Cons:

- Opaque Pricing: You must contact them for a custom quote, as pricing is not public.

- Shared Lead Competition: As with most shared lead models, immediate follow-up is critical to success.

8. InsuranceLeads.com

InsuranceLeads.com is one of the more established players in the lead marketplace, offering a broad spectrum of lead types across auto, home, health, life, and renters insurance. This platform is a strong contender among insurance lead generation companies for agents who require flexibility and a wide selection of verticals. It operates on a self-serve model with a 24/7 agent portal, giving agents direct control over their campaign configuration without being locked into long-term contracts.

The company provides both shared and carrier-exclusive leads, with pricing clearly outlined on its website, which fosters transparency. Agents can set up campaigns with specific geographic targeting and apply various optional filters to refine their audience, though these add-ons come at an increased cost per lead. The model is built for speed, making it crucial for agents to have a rapid follow-up process to succeed with shared leads.

Key Features & Ideal Use Case

Website: https://www.insuranceleads.com/

InsuranceLeads.com is best suited for agents or agencies looking to source leads across multiple insurance lines from a single platform. Its no-contract, self-serve nature appeals to those who want to test different markets and filters without significant commitment. The platform is particularly effective for agents with robust systems for immediate lead contact.

| Feature Analysis | Implementation & Use |

|---|---|

| Multi-Line Lead Options | Diversify your lead flow by running simultaneous campaigns for auto, home, and life insurance within one portal. |

| Self-Serve Configuration | Use the 24/7 agent portal to adjust geographic targeting, pause campaigns, or add filters based on performance. |

| Optional Data Filters | Enhance lead quality by adding filters for specific criteria, but monitor your ROI as this increases the cost-per-lead. |

| Generous Return Policy | Leverage the return policy to get credit for invalid leads, such as disconnected numbers or fake contacts, protecting your budget. |

Pros:

- Broad Line Coverage: Offers a wide variety of insurance lead types.

- Flexibility & Control: No long-term contracts and a 24/7 self-serve portal for campaign management.

- Transparent Pricing: Clear cost structure for different lead types and filters.

Cons:

- Shared Lead Competition: Many leads are shared, so speed-to-contact is critical for success.

- Increased Costs: Add-on filters can significantly raise the price of each lead.

9. All Web Leads (AWL)

All Web Leads (AWL) is one of the largest and most established insurance lead generation companies in the United States, offering high-volume lead flow across nearly all major insurance verticals, including auto, home, life, health, and business. The company distinguishes itself with a more hands-on approach, providing dedicated onboarding and campaign optimization support to help agents maximize their return on investment. This makes it a strong choice for agencies that value partnership and guidance alongside lead volume.

AWL’s platform provides a dedicated agent portal for managing campaigns, billing, and performance reporting. A key advantage for agents affiliated with major carriers is the availability of special pricing programs and partnerships, which can offer preferred rates. While many leads are shared, the company's sheer scale ensures a consistent and predictable supply for agents looking to fuel a large sales pipeline.

Key Features & Ideal Use Case

Website: https://awl.com/agents/

AWL is best suited for established agencies or carrier-affiliated agents who need a consistent, high volume of leads across multiple insurance lines and appreciate a supportive, service-oriented relationship with their lead provider. The campaign optimization assistance is particularly valuable for teams that may not have the internal resources to constantly fine-tune their lead-buying strategy.

| Feature Analysis | Implementation & Use |

|---|---|

| Agent Management Portal | Use the portal to track lead performance, manage your budget, and access billing history in one centralized location. |

| Broad Targeting Options | Define your ideal customer by geography and product line, with leads delivered directly to your email or CRM. |

| Onboarding & Optimization | Work directly with your AWL representative during setup to align campaign filters with your business goals and underwriting appetite. |

| Carrier-Specific Programs | Inquire about partnerships with your carrier to access potential discounts or co-op marketing funds. |

Pros:

- High Volume & Scale: Established infrastructure provides a reliable source of leads across most insurance types.

- Hands-On Support: Dedicated onboarding and optimization assistance helps new users get started effectively.

- Carrier Partnerships: Special pricing programs can provide a competitive cost advantage.

Cons:

- Variable Pricing: Costs can differ significantly based on the lead type and specific carrier program.

- Shared Lead Competition: Many product lines feature shared leads, requiring rapid speed-to-contact.

10. Aged Lead Store

Aged Lead Store offers a distinct approach compared to other insurance lead generation companies by specializing in aged leads. This platform provides a marketplace for purchasing older leads across life, health, auto, and home insurance verticals at a fraction of the cost of real-time leads. It is designed for agents and teams with robust follow-up systems who can leverage volume to find opportunities within a lower-intent pool.

The platform operates like a self-serve e-commerce store where buyers can filter inventory by lead age, location, and insurance type. Pricing is transparent and tiered based on volume and age, allowing agencies to purchase large data sets for their outbound campaigns. This model is built for scale, enabling teams to feed their auto-dialers and CRMs with a consistent flow of contacts to work.

Key Features & Ideal Use Case

Website: https://agedleadstore.com/

Aged Lead Store is best suited for high-volume call centers or agencies equipped with dialers, CRMs, and dedicated staff for outbound prospecting. The primary goal is to maximize outreach at the lowest possible cost per contact, understanding that conversion rates will be significantly lower than with fresh leads. Success depends entirely on having an efficient process to sift through large volumes of data.

| Feature Analysis | Implementation & Use |

|---|---|

| Self-Serve Store | Browse and purchase leads on-demand with transparent, upfront pricing. Download leads instantly as CSV files. |

| Advanced Filtering | Filter lead inventory by state, ZIP code, and age (from days to years) to build highly specific campaign lists. |

| Tiered Pricing | The cost-per-lead decreases as you buy in larger quantities, making it cost-effective for large-scale operations. |

| Educational Resources | Provides playbooks and guides on how to effectively work aged leads, helping teams optimize their follow-up strategy. |

Pros:

- Extremely Low Cost: The lowest cost-per-lead available, allowing for massive scaling of outreach efforts.

- High Volume: Access to large inventories of leads across multiple insurance lines.

- Simple Acquisition: Easy-to-use platform for quick filtering and purchasing.

Cons:

- Low Conversion Rates: Contact and conversion rates are inherently lower than with real-time leads.

- Requires Infrastructure: A dialer, CRM, and strong follow-up processes are essential for success.

11. Centerfield Insurance Services (formerly Datalot)

Centerfield Insurance Services, the division that absorbed Datalot, operates as an enterprise-level digital demand generation platform. It serves major insurance carriers and large agencies by developing high-volume, data-driven customer acquisition programs. This company stands out among other insurance lead generation companies by focusing on bespoke, integrated solutions rather than a self-serve marketplace, making it a strategic partner for organizations with significant scale.

The platform generates leads through its own consumer-facing properties and extensive performance marketing channels, then delivers them via warm transfers or direct data integration. Pricing and engagement are customized through service agreements, which means it’s not designed for individual agents looking to buy leads on an ad-hoc basis. Instead, it builds entire acquisition funnels tailored to a partner's specific goals and underwriting criteria.

Key Features & Ideal Use Case

Website: https://www.datalot.com/

Centerfield is best suited for national carriers or enterprise-level agencies that require a high-volume, consistent flow of qualified leads and can support deep technical integration. The service is structured to function as an outsourced customer acquisition department, managing everything from initial digital advertising to routing qualified prospects directly into a partner’s sales workflow.

| Feature Analysis | Implementation & Use |

|---|---|

| Digital Demand Generation | Leverages Centerfield's performance marketing expertise to create large-scale lead funnels for specific insurance products. |

| Live Consumer Marketplace | Engages consumers on proprietary websites and routes them in real-time to partner agents or call centers via warm transfers. |

| Carrier/Agency-Specific Agreements | Establishes custom integrations and lead delivery protocols tailored to a partner's existing CRM and sales processes. |

| Data-Driven Acquisition | Utilizes advanced analytics to optimize campaigns for conversion rates and cost-per-acquisition, aligning with partner KPIs. |

Pros:

- Enterprise Scale: Deep experience in building and managing high-volume lead campaigns for major carriers.

- Integrated Solutions: Can be tightly woven into existing carrier sales and technology workflows for seamless operation.

- Performance-Focused: Strong emphasis on performance marketing and optimizing for partner-specific business outcomes.

Cons:

- Not for Independent Agents: The model is built for large-scale partnerships, not individual agent access.

- Bespoke Pricing: Costs are not transparent and are negotiated based on volume and scope, requiring a consultation.

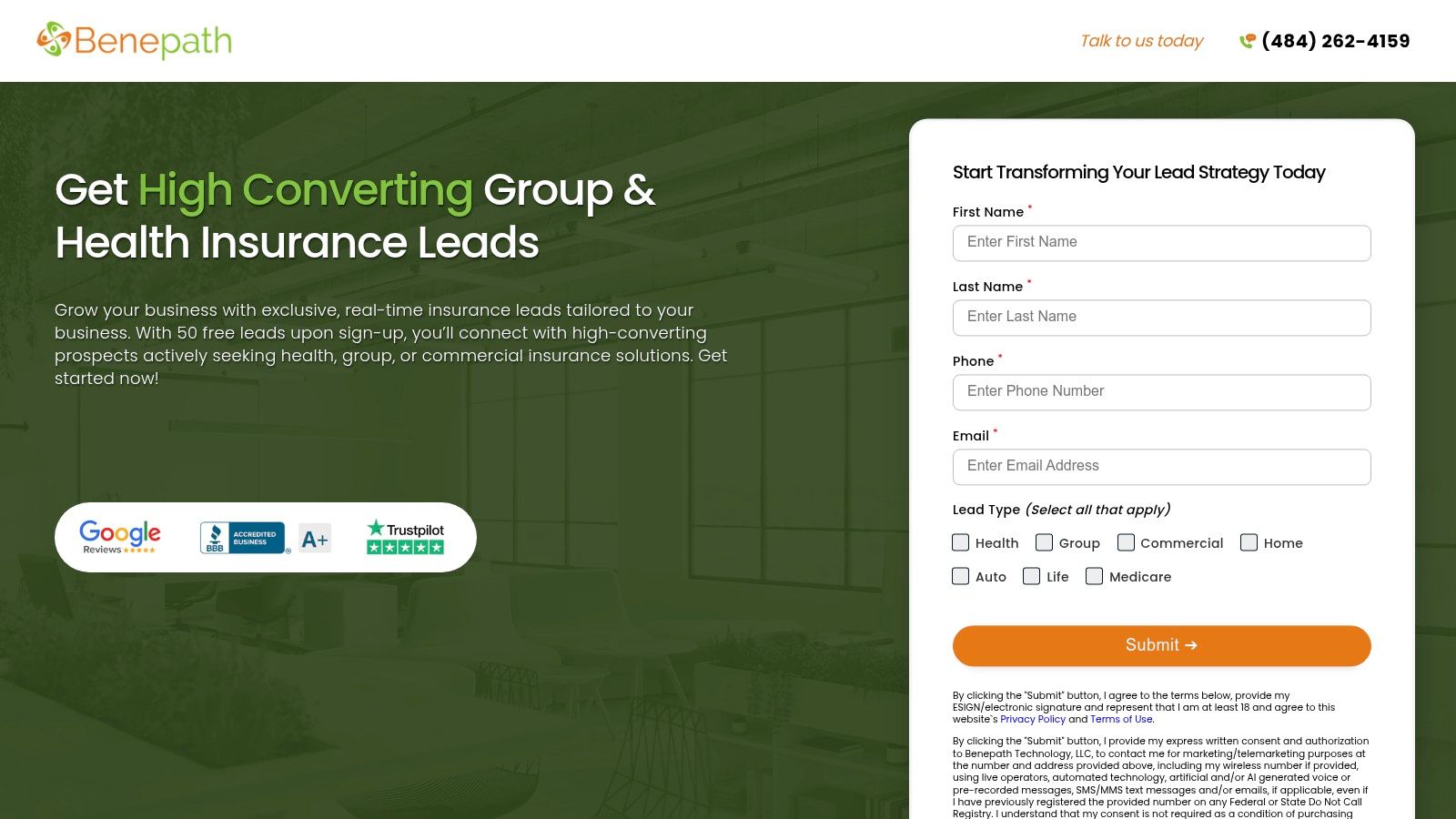

12. Benepath

Benepath carves out a niche in the market by focusing on delivering exclusive, real-time insurance leads to a single agent per territory. Specializing in health, group, Medicare, life, and P&C insurance, it operates by generating traffic through its own portfolio of websites and delivering qualified prospects directly. This model makes it one of the go-to insurance lead generation companies for agents who want to eliminate direct competition for each lead they purchase.

The company's commitment to exclusivity is its primary differentiator. By ensuring a lead is sold only once, Benepath provides agents with a higher likelihood of contact and conversion. Their pricing structure, with published sample costs for some lines, offers a degree of transparency, though actual costs will depend on the specific territory and lead type.

Key Features & Ideal Use Case

Website: https://www.benepath.net/exclusive-insurance-leads/

Benepath is best suited for established agents or agencies that have a robust follow-up process and are willing to pay a premium for exclusive access to prospects. The territory-based system works well for agents looking to dominate a specific local market without facing immediate competition from other agents who bought the same lead data.

| Feature Analysis | Implementation & Use |

|---|---|

| Exclusive, Territory-Based Leads | Secure your designated geographic area to receive all leads of a specific type, ensuring you are the only agent contacting them. |

| Owned & Operated Web Properties | Leads are generated in-house, giving Benepath direct control over the marketing message and initial prospect qualification. |

| CRM/API Delivery | Integrate leads directly into your existing CRM for seamless and automated workflow management and nurturing sequences. |

| Clear Return Policy | Offers a straightforward process for returning leads with bad data or those that don't meet quality standards, protecting your budget. |

Pros:

- Reduced Competition: Exclusive leads mean you are the only one working that prospect, increasing conversion potential.

- High Intent: Leads are generated in real-time from consumers actively searching for insurance information.

- Territory Control: The ability to "own" a territory for a specific lead type can build a strong local presence.

Cons:

- Higher Cost: Exclusive leads command a premium price compared to shared or aged lead alternatives.

- Limited Availability: Desirable territories or specific insurance lines may have limited inventory or a waiting list.

Top 12 Insurance Lead-Gen Companies Comparison

| Vendor | Core Offering | Quality ★ | Price 💰 | Target 👥 | USP ✨ |

|---|---|---|---|---|---|

| NextGen Leads | Real-time health/Medicare & auto leads, buyer dashboard, CRM sync | ★★★★ | 💰💰 | 👥 Health/Medicare agents wanting control | ✨ Granular targeting + easy bad-lead returns |

| SmartFinancial for Agents | Shared & exclusive data leads, live transfers, agent coaching | ★★★★ | 💰💰 | 👥 Agents wanting high volume + training | ✨ Wide product mix + agent success programs |

| QuoteWizard (for Agents) | SEM-driven web leads & live transfers, nationwide coverage | ★★★★ | 💰💰 | 👥 Teams needing consistent national supply | ✨ High-volume SEM traffic for scale |

| EverQuote for Agents | Data leads, inbound calls, optional Lead Connection Service (LCS) | ★★★ | 💰💰💰 | 👥 Agents wanting outsourced working of leads | ✨ LCS concierge that pre-qualifies & transfers |

| MediaAlpha for Agents | Programmatic auction + browse-and-buy with source transparency | ★★★★ | 💰💰 | 👥 Agents who actively manage bids/campaigns | ✨ Pre-purchase lead attribute visibility |

| ZipQuote | Non-incentivized internet leads & live call transfers, advisor support | ★★★★ | 💰💰 | 👥 P&C agents seeking intent-driven leads | ✨ Higher-intent, non-incentivized sources |

| Hometown Quotes | Custom pricing, CRM/raters integrations, carrier-approved programs | ★★★ | 💰💰 | 👥 Captive agents & carrier-coop participants | ✨ Carrier-approved vendor access & promotions |

| InsuranceLeads.com | Multi-line self-serve portal, geographic filters, generous returns | ★★★★ | 💰💰 | 👥 Agents wanting flexibility without contracts | ✨ 24/7 portal + broad filtering options |

| All Web Leads (AWL) | Large-scale leads & live calls, agent portal, onboarding support | ★★★★ | 💰💰 | 👥 High-volume agents & brokerages | ✨ Hands-on onboarding + carrier programs |

| Aged Lead Store | Bulk aged leads by state/ZIP, transparent tiered pricing | ★★ | 💰 | 👥 Teams with dialers & follow-up capacity | ✨ Lowest cost-per-contact for scale |

| Centerfield Insurance Services | Enterprise digital demand gen, live marketplaces, carrier integrations | ★★★★ | 💰💰💰 | 👥 Carriers & large agencies | ✨ Enterprise-grade performance marketing & integrations |

| Benepath | Exclusive territory-based real-time leads, CRM/API delivery | ★★★★ | 💰💰💰 | 👥 Agents wanting exclusivity by territory | 🏆 Exclusive leads with clear return policies |

Beyond Buying Leads: Maximizing Your ROI with Smart Follow-Up

Navigating the landscape of insurance lead generation companies can feel overwhelming, but as we've explored, the right partner can fundamentally reshape your agency's growth trajectory. From real-time exclusive leads offered by platforms like NextGen Leads and SmartFinancial to the high-volume, shared-lead models of QuoteWizard and EverQuote, each vendor presents a unique set of opportunities and challenges. We've also seen how specialized providers like Aged Lead Store can offer a cost-effective way to fill your pipeline, while comprehensive platforms such as MediaAlpha provide granular control for the data-driven agent.

The central takeaway is clear: there is no single "best" provider. The ideal choice hinges entirely on your agency’s specific needs, operational capacity, and strategic goals. A brand-new agency might prioritize the lower cost-per-lead of aged or shared leads to build initial momentum, while a well-established home service business with a robust sales team may invest in premium, exclusive leads to maximize conversion rates and policy value.

Key Takeaways and Your Next Steps

Before you sign a contract with any of the insurance lead generation companies listed in this guide, it's crucial to internalize that purchasing leads is just the first step. The real differentiator between stagnation and explosive growth lies in your follow-up process.

Here are the most critical actions to take now:

- Define Your "Ideal Lead": Before evaluating vendors, create a clear profile of your target customer. What lines of insurance are most profitable for you? What demographics convert best? This profile will be your north star when comparing lead filtering options.

- Assess Your Follow-Up Capacity: Be brutally honest about your team's ability to contact new leads. Can you genuinely guarantee a call within five minutes of receiving a lead? If not, your ROI will suffer, regardless of lead quality.

- Start Small and Test: Never commit to a large, long-term contract without a pilot program. Allocate a small, fixed budget to test two or three promising vendors. Track every metric meticulously: contact rate, quote rate, close rate, and cost per acquisition.

- Integrate with Your CRM: Manual lead management is a recipe for failure. Ensure your chosen lead provider integrates seamlessly with your CRM to automate lead distribution, track interactions, and trigger follow-up sequences. This creates a system for success, not just a list of names.

For those keen on understanding the potential for high-volume lead acquisition, exploring case studies on rapid lead acquisition results can provide valuable insights into what's possible with a well-oiled system.

The Real Bottleneck: Speed to Lead

Ultimately, the most significant factor impacting your success with purchased leads is your speed to lead. A lead’s value depreciates with every passing minute. For a busy home service business owner, where team members are often in the field or handling client-facing tasks, this presents a major operational bottleneck. You can buy the highest-intent leads in the world, but if they go cold before you can contact them, the investment is wasted.

This is where a strategic partnership becomes a force multiplier. Pairing one of the top-tier insurance lead generation companies with a dedicated follow-up solution creates a predictable, scalable growth engine. Instead of stretching your internal team thin, you can leverage specialized services designed to handle the critical first touchpoint, ensuring no opportunity slips through the cracks. By solving the follow-up problem, you unlock the true potential of your lead generation budget and position your agency for sustainable, long-term success.

If your team is struggling to keep up with lead follow-up, Phone Staffer can help. Our trained, remote CSRs and done-for-you cold calling services ensure every lead is contacted instantly and professionally, booking qualified appointments directly onto your calendar. Stop letting valuable leads go to waste and start maximizing your ROI by visiting Phone Staffer to learn how we can build your growth engine.